Goa is abuzz with excitement as vintage bike and car owners, users, collectors and fans are decking […]

DON’T FALL INTO NIRMALA’S TRAP!!

Cover Story, Feb 08- Feb 14 2020 February 7, 2020SHOCK: The ordinary people are in shock over the proposal in the budget to sell The Life Insurance Corporation of India, the only institution that we could trust, after the banks.

BY RAJAN NARAYAN

Settled for the old tax rates with all the tax benefits. The new lower tax rates are a con because you will have to give up all the tax benefits you have enjoyed. You will actually end up paying more taxes. But what has shocked the people and shaken their faith in the government is the proposal to sell the LIC which is the only financial institution left that people trust. Goa’s expectations were crushed as there was nothing in the budget for Goa. Not even a new suburban railway system as promised to Bengaluru

By Rajan Narayan

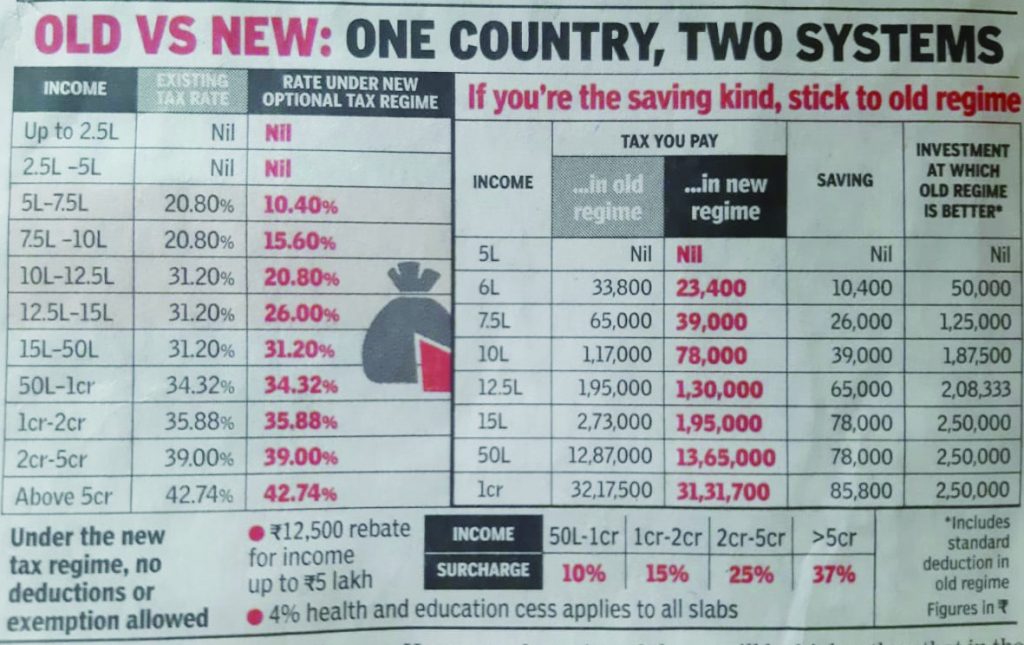

FINANCE Minister Nirmala Sitharamanhas offered you the choice of choosing your own tax regime. You can choose a new tax option where the rates of interest are lower, but you will not be entitled to all the standard deductions for savings, housing loans, education allowance, etc, etc. Which together allowed you to save over 1 lakh of the tax payable. Let us give an example. In the new tax option that Nirmala has offered you don’t have to pay any taxes on an income up to5 lakh. Even for income between 5 to7.5 lakh, the interest rate has been reduced to 10.40%. If your income is in between 7.5 to10 lakh you will pay only 15.60% instead of the earlier 20%. Only after income crosses 15 lakh level you will have to pay 30% of your salary as tax.

No tax benefits

On the face of it seems to be a great deal. But the catch is that if you opt for the new tax system you will not able to claim any deductions. Historically, though the tax rate on incomes above 5 lakh tended to be 30% or more you got a lot of deductions. All these deductions meant that if you had the salary of7.5 lakhs but claimed the various tax benefits against school fees, Mediclaim, housing loan and standard tax reduction of 50,000 you would pay the higher rate on the reduced income of6 lakh that your income was reduced to because of the tax benefits.

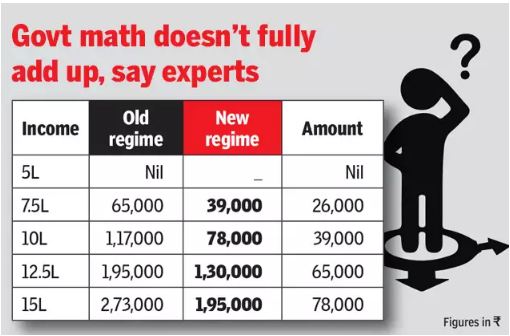

The moment we switch to the new system which has relatively much lower taxes you will not be able to avail of any of the benefits which on a salary of 7.5 lakhs amounts to1.5 lakhs. So the choice is between paying 30% on `7.5 lakhs or 15% on the same amount without any deductions. As the experts are pointing out the government maths will not benefit you. It is a con.

Resist temptation

For instance, except for those with salaries of 5 lakh and above, you will lose out if you are tempted by the lower percentages that the new systems offers. On a salary of7.5 lakhs under the old regime you are liable to pay 26,000 as tax. If you fall for Nirmala’s bait you will end up paying39,000 as tax (13,000 more). Similarly, if you are now getting a salary of10 lakh in the old system you would have paid 39,000 as tax, whereas it will shoot up to almost double to78,000 if you accept Nirmala’s devious offer.

GOOD OLD RATES

ON a salary of 12.5 lakh you will have to pay1.30,000 in the new regime as against 65,000 if you settle for the good old rates. If your salary is15 lakh per year you will have to pay almost three times higher tax in the new system than in the previous system. Going by the existing rates the tax on a salary of 15 lakhs is78,000. If you walk into Nirmala’s trap your tax will shoot up to 1,95,000. So if you belong to the middle-class and are not an expert you would be well advised to stick to the old system. Where you taxable salary will come down to the extent that you take advantage of all the exemptions including those for housing allowance (3 lakh); standard reduction 50,000 which together brings down your net taxable income to11,500. On this amount you further avail of deductions under Section 80C of the Income Tax Act for savings and investments your taxable income will come down to `10 lakhs.

Maximum rate

Even if you pay the maximum rate of 20.8% under old regime and 26% in new regime the additional tax burden in the new regime will be `78,000. The net loser is not only new tax payer but also institutions like LIC and Mutual Funds. Your friendly chartered accountant would always advise you to invest in LIC where the returns are pathetic not because you wanted to make provision for your family if anything happened to you but because you would pay taxes on a lower taxable salary adjusted for the investment you have made. Which was substantial because the entire premium you paid or the investment you made in Mutual Funds and authorized investments would be deductible from you salary for payment of tax.

Talking of the LIC forget about losing the benefit of tax exemption for your LIC premium, the government is threatening to sell the organization, The Life Insurance Corporation of India to private parties. The LIC has been the most profitable government organization. It has been the source of comfort for 150 crore Indians. The first thing that any new papa or mommy do when a child is born is to take out an education LIC policy in the child’s name. This ensures that if anything happen to dear papa, mommy LIC would continue to pay them. LIC was far more trustworthy by a mother saving for her children than the government’s Ladli Laxmi scheme.

Here again the LIC plays on the fear factor of something happening to the main breadwinner of the family. But the most popular of the dozens if not hundreds of LIC policies has been the policy on the life of the main breadwinner. Depending on their ability parents can ensure even up to a hundred crore, provided they have money to pay the premium, which their children will automatically receive if papa gets drowned for not listening the Drishti lifeguards while swimming in the dangerous waters off Miramar beach.

zero to hero

If you are one of those zero to hero students like MS Dhoni or Salman Khan, the LIC invites you to make a bulk payment or premium instead of spreading it over the years. So Dhoni and Salman Khan when they reach the top and are earning `300 crore per year can by paying a big premium offer a safety net to their children. It was the even more attractive investment they made to safeguard the future of their children and ensure that they would continue to enjoy the luxuries of life because they were tax free. But not if you adopt the new tax regime.

LOSING FAITH

MOST of middle-class people have started losing faith in public sector banks after revelations of people like Vijay Mallya, Nirav Modi and their ilk, looting public sector banks to the extent of thousands of crore. There is the case of Anil Ambani whose telecom company owes the bank 35,000 crore and may survive only if his brother Mukesh Ambani helps him out. But for people like you and me who have faithfully and with great trust put our money in fixed deposits for regular income or pension or as safety net to come to our rescue when we are in dire need, nobody will come to save us.

The only pitifully small consolation is that in the latest budget the amount of your savings in nationalized banks the insurance has risen from1 lakh to 5 lakh. This will offer little consolation to those who have more than5 lakh worth of fixed deposits in nationalized banks or even private banks. Even if you have 50 lakh or500 lakhs in Fixed Deposit the amount you will be able to recover if the bank mismanages, goes broke and shuts down, is only 5 lakh.

The most unreliable are the co-operative banks. The Mapusa Urban Co-operative Bank. Which has been controlled by Congress politicians and former Union Law Minister Ramakant Khalap has virtually shut down. You cannot withdraw more than10,000 per month from the bank. This is because the directors and their friends have allegedly stolen a large part of your deposits by giving themselves loans. The most tragic example is of the people who kept their money in the Punjab Maharashtra Co-operative Bank which shut down. The bank had been looted by one of its own directors, a small time industrialist.

In a situation where people have lost faith in co-operative and nationalized banks the last institution which enjoyed credibility and commanded the faith of people was the LIC. Now with a proposal to sell off the LIC to private parties even this avenue of savings may disappear. It is not known whether the sovereign guarantee of the Government of India will continue when LIC become a private sector organization.

Grim ground reality

The grim ground reality is that the BJP government does not have any more money to give to farmers. The ground reality is that the income of the Modi government has steadily fallen from the time it came to power with a huge majority in 2014. This is because demonetization and GST destroyed the faith of the people in the government. The RBI has now admitted that no black money was recovered because of Demonetisation. If the indirect taxes like sales and excise have fallen it is because they are all combined into GST. The GST is so complicated that even the finance minister will find it difficult to keep track of the rates for various products and ensure payments are made on time. Not surprisingly GST collections have been much less than expected.

Goa gst revenue

This has affected not only the revenue of the Modi government but also the revenue of the BJP government of Goa. This is because under the GST the states were persuaded to forego all taxes on all commodities exception for daroo. Earlier the state used to earn a lot of revenue from the excise sales tax and entry tax and other taxes they levied. They were persuaded to stop levying these taxes and promised their share of GST revenue. But since the Central GST revenue has been less than half of the expectation, Indian states will also have to be satisfied with a lower share of GST.

For instance, the state of Goa has got less than 20% of its share of the GST collections. This has forced the state of Goa to borrow money every month to pay the salaries of its 60,000 odd employees. The revenue of the government has fallen because the growth rate has fallen. Because the rate of growth of industry has fallen. Which means people are buying fewer cars, scooters and televisions sets. May be all the money earlier used to buy televisions sets has been diverted to buying smart phones. Because with smart phones you don’t need either to read newspapers, watch TV or films, because it’s all there on your smart phone now. Lower production means lower income by way of taxes to government.

To ensure that industrial production improves the government has to make sure that there is more money in the hands of the people. That more jobs are created. And more importantly workers are not sacked because of the drop in demand. The automobile industry which includes two-wheelers has sacked more than 10 lakh people since the demand for two-wheelers and cars has dropped. The IT industry which used to hire fresh engineers by the lakh has started sacking them instead.

purchasing power

With lower output, higher unemployment, the purchasing power of the aam aadmi has fallen drastically. Which is why we are not able to meet the tax expectations of the Finance Minister Nirmala Sitharaman. She thought she could take all of us for a ride by introducing a new tax regime with lower taxes so that the middle-class will be happy and start buying scooters and motor cycles again. Except that the over- clever Nirmala has robbed Peter to pay Paul. She has offered lower tax rate only to those who are willing to expect any of the tradition of the tax benefits. The real problem with the Modi government is not the polarization if the country along communal lines. May be the Minister of State for Finance would have got away with his inflammatory statement, “Goli maro sallo par” if the economy had prospered. It is the collapse of the economy that has led to a loss of faith in the Narendra Modi government.