Goa is abuzz with excitement as vintage bike and car owners, users, collectors and fans are decking […]

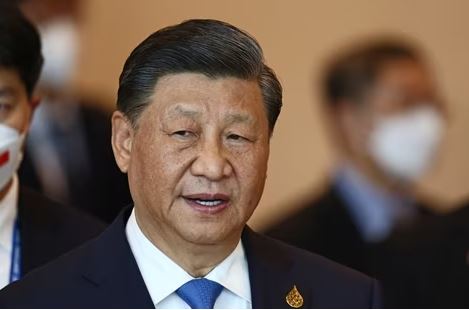

CHINESE WEALTHY FLEEING COUNTRY! By Aadil Brar

Uncategorized January 27, 2023Chinese citizens are looking for ways to relocate abroad rather than just move their assets. But Xi Jinping’s tactics to exert ‘ethnonationalist power’ won’t be easy to escape.

By Aadil Brar

As in the case of India, the bold and the beautiful and the rich and the powerful in China, are also relocating to the UK, USA, Canada, Australia or the European countries. They are increasingly disturbed by the vitiated covid-19 crackdown by President Xi Jinping …

China’s wealthy citizens are chalking up plans to move to other countries as domestic politics on the mainland remain complex. Chinese citizens are looking for ways to physically relocate abroad rather than just move their assets through investments.

There are chat groups on platforms such as GitHub where running away from China is a phenomenon described as ‘runology’. But now China’s wealthy are joining the chorus to relocate.

Japan, Singapore and some Southeast Asian countries are the preferred destinations for the wealthy who have seen the Chinese government invade their private spaces, justifying the actions of pandemic control.

Earlier, the Chinese would invest in the US, Canada, and Europe to move their wealth accumulated over three decades of economic growth. But that trend slowed down during the Trump presidency as the wealthy feared backlash in Western countries resulting from the geopolitical competition between Beijing and Washington and ‘racial’ backlash following the onslaught of the Covid pandemic.

The US, Australia, Canada, and Europe are no longer the top destinations for wealthy Chinese as the geopolitics and domestic concerns about the asset bubble have been introduced for the movement of capital.

But even when the rich Chinese invested their money in Canada or Portugal, they weren’t physically relocating. The business investment visas in Western countries were an asset diversification strategy, which appears to be changing as some wealthy Chinese find China’s domestic politics full of uncertainty.

New destinations–Japan, Singapore

Japan, one of the destinations preferred by the wealthy Chinese, may appear hawkish towards Beijing on the foreign policy front, but Tokyo doesn’t seem to have any qualms about China’s wealthy parking their money in their economy.

A Chinese businesswoman who has lived in Japan for almost three decades, in an interview to The Wall Street Journal, gave an example of officials forcefully entering the apartment of a colleague in China and spraying disinfectant.

In the past weeks, Jack Ma (his real name is Ma Yun) appeared in Tokyo after taking a back seat from his business as Beijing’s tech crackdown continued with full steam. After his six-month stay in Japan, Ma was also recently seen in Bangkok, where he has been learning agricultural technology for his next venture.

Japan offers a business investment visa that wealthy Chinese use to enter the country. The visa is relatively attractive as a foreigner must make an investment of $40,000 as against $800,000 for the US and $1.85 million for Singapore visas.

Singapore is another destination where China’s wealthy have moved their money. Described as ‘Asia’s Switzerland’, Singapore was always pitted as a destination to escape the geopolitical squabble between the US and China. But it is only now that the investment pitch has gained more currency.

One such instance of overwhelming interest in Singapore is the number of Rolls Royce cars registered in Singapore having surged between 2021 and 2022 – there is now a year-long waitlist. Buyers from the Chinese mainland are driving the demand for these cars.

Hong Kong’s declining prospect after the passing of the National Security Law has revived the prospects of Singapore.

“For many years, Singapore has liked to sell itself as the Switzerland of Asia. The new cold war, says one former top official, is finally turning that pitch into a reality. The big question, though, is how far Singapore will tolerate being Switzerland with Chinese characteristics,” reported Mercedes Ruehl and Leo Lewis for Financial Times.

Singapore received foreign investment to the tune of $8.2 billion in the first six months of 2022, which was double that of Malaysia, the next best performing country in Southeast Asia.

Political uncertainty is a major factor

Singapore is particularly attractive because of the private wealth managers who offer a series of investment solutions and tax-saving measures. One popular approach is setting up family offices, which offer tax exemptions.

“The anecdotal evidence is that private companies and family offices are moving to Singapore a big way from the mainland and even from Hong Kong. Singapore gives them a degree of freedom even more than Hong Kong. The property prices have shot up a lot, and the school admissions [have] gone up as well because of the Chinese expats moving to Singapore. Rentals have spiked as Hong Kong expats have moved out and then followed the Chinese mainland,” said Aninda Mitra, vice-president and the head of Asia Macroeconomics and Investment Strategy at BNY Mellon Investment Management in Singapore, in an interview with the author.

“In China, political uncertainty has emerged, and Chinese policies have gone in multiple directions, whether it is on the Covid front or the technology front. The nationalistic impulses of the new government, which will run the country from March onwards when the new premier and politicians’ step in, is quite clear and adds to the uncertainty. The uncertainty in the politics remains reflected by the current hedging strategy we see in the capital flows outside of the Chinese mainland into Japan, Singapore, and other countries in the region,” Mitra told me.

Beijing’s Covid response isn’t the only reason that China’s wealthy are once again becoming mobile. Chinese state-owned enterprises are taking a bigger stake in private enterprises. Recently, the Chinese government acquired a ‘golden share’ in two Alibaba units, a tactic to gain decision-making control in a company’s operations.

“These golden shares, typically equal to about 1% of a firm, are bought by government-backed funds or companies which gain board representation and/or veto rights for key business decisions,” reported Reuters.

The Beijing government is taking a heavy-handed approach towards allocating funds in sectors it believes should get the State’s support. The government recently blocked listing of ‘red light’ companies – such as restaurant chains – in the country’s stock exchanges to channel the funds to certain sectors.

The preferred sectors include the areas of high technology competition with the US such as semiconductor chip design, artificial intelligence, and next generation network technologies which both sides are vying to dominate.

China’s wealthy may have managed to escape with their assets to more favourable locales. But given the country’s recent history, Beijing would double its efforts to surveil its citizens outside its boundaries.

Xi Jinping’s long-arm tactic to exert extra-territorial ‘ethnonationalist power’ wouldn’t be easy to escape for the wealthy.

he author is a columnist and a freelance journalist. He was previously a China media journalist at the BBC World Service. He is currently a MOFA Taiwan Fellow based in Taipei and tweets @aadilbrar. Views are personal.

(Edited by Prashant)

Courtesy: The Print