CHEATED: It is at the cost of public account that Gautam Adani has become a billionaire. It is the Life Insurance Corporation and the State Bank of India, both public sector undertakings, which financed the fraud.

By Livemint

The American Company Hindenburg has repeated that fraud cannot be hidden or excused by nationalism. The majority of the funds of Gautam Adani were gifted by the Life Insurance Corporation and the State Bank of India.

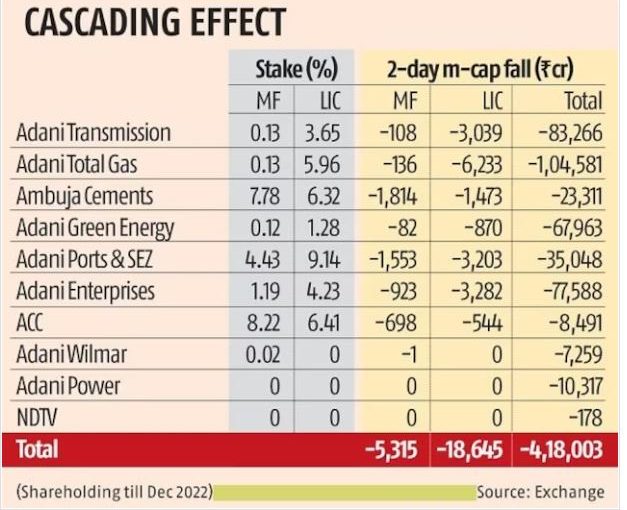

World’s richest Indian, Gautam Adani has lost Rs4 lakh crore in the last couple of days after a U.S. short seller casted doubts on how investors will respond to the company’s record $2.45 billion secondary sale. In today’s trade alone his losses stretched to Rs2.83 lakh crore.

Seven listed companies of the Adani conglomerate – controlled by one of the world’s richest men Gautam Adani – have lost a combined Rs4 lakh crore in market capitalisation since Wednesday, with U.S. bonds of Adani firms also falling after Hindenburg Research flagged concerns in a Jan. 24 report about debt levels and the use of tax havens.

J.P.MORGAN

“While the Hindenburg report focused mainly on equity valuations within the group, we are primarily concerned about the underlying credit profiles of group companies given underlying bank exposures.

“We think the underlying assets at the bond level are quite adequately leveraged while the promoter-level is an unknown and is something that can be mitigated only through an equity raise, such as the ongoing Adani Enterprises FPO.”

JOSHUA CRABB, HEAD OF ASIA-PACIFIC EQUITIES AT ROBECO, HONG KONG

“These short-seller reports usually cause a dramatic impact in the short term and the medium-term impact is driven more by the fundamentals and how the company responds to the allegations. Clearly given the size of the group and outstanding debt, this has also impacted the banks.”

SAURABH JAIN, ASSISTANT VICE-PRESIDENT, RESEARCH, SMC GLOBAL SECURITIES, NEW DELHI

“The selloff is seriously extreme in the sense … it has clearly dented the overall investor sentiment in the market. The nervousness has led to a fall in stocks across the board. When a selloff of this kind of magnitude is seen in a very short span of time, investors sell other stocks where they are in the money. Sentiments have turned slightly bearish.”

NEERAJ DEWAN, DIRECTOR AT QUANTUM SECURITIES, NEW DELHI

“Everyone had big positions in the stocks … So if a report comes and stocks see a sharp fall, lot of margin calls also get triggered. Those also add to selling pressure. This is a classic case of panic selling. Selling is impacting the banking sector. At least 40% of the group’s debt is exposed to Indian banks, so that exposure is what people are worried about in banks.

Courtesy: The LIvemint