IN today’s digital world cyber frauds have become increasingly sophisticated, targeting vulnerable populations, especially the elderly. Every time we make a phone call these days, we hear automated warnings about cyberfrauds, highlighting the growing threat. Scammers use various methods to exploit unsuspecting individuals, often preying on those unfamiliar with digital security. Awareness of their modus operandi and preventive measures is crucial to avoid falling victim to these crimes. Several people have been cheated in our Goa and it is happening throughout the country. The problem is bigger than what is reported.

Examples of Cyber Frauds Against the Elderly

Phishing Scams: Fraudsters pose as representatives of banks, government agencies, or telecom providers, tricking elderly individuals into sharing sensitive information like OTPs (one-time passwords), Aadhaar details and bank account credentials.

Example: In Mumbai, a 70-year-old pensioner lost Rs5 lakh after clicking a fraudulent bank link that stole his login credentials.

Lottery & Fake Prize Scams: Victims receive calls or messages claiming they have won a lottery or lucky draw and need to pay a processing fee or share banking details to claim the prize.

Example: An elderly woman in Delhi was duped into transferring Rs2 lakh for a “prize” that never existed.

Tech Support Scams: Scammers pose as IT professionals from reputed companies, claiming that the victim’s computer has a virus. They ask for remote access to “fix” the issue, only to install malware or steal data.

Example: A retired professor in Bangalore lost Rs3 lakh when scammers installed spyware on his laptop under the pretense of tech support.

Investment Fraud and Pension Scams: Fraudsters offer fake investment schemes promising high returns, leading elderly individuals to invest their life savings.

Example: A senior citizen in Chennai lost Rs10 lakh in a Ponzi scheme that promised doubled returns in six months.

Romance & Social Media Scams: Scammers befriend elderly individuals on social media, build emotional trust, and eventually request financial assistance.

Example: An elderly widower in Pune was conned into sending Rs3 lakh to a scammer posing as a foreign doctor in distress.

KYC (Know Your Customer) Update Fraud: Fraudsters call pretending to be from banks, claiming that the victim’s KYC needs updating. They ask for confidential details and use them for financial fraud.

Example: In Kolkata, a retired government officer lost Rs4 lakh after sharing his debit card details over the phone.

How to stay safe and alert

Never Share Personal Information: Avoid disclosing OTPs, PINs, Aadhaar numbers, or passwords to anyone over the phone or online.

Verify Before Trusting Calls or Messages: Always cross-check with the official source before acting on messages or emails.

Avoid Clicking Suspicious Links: Do not open links from unknown sources, as they may contain malware viruses.

Use Strong Passwords and 2-Factor Authentication: Ensure strong, unique passwords and enable extra security layers for online accounts.

Monitor Bank Statements Regularly: Report any unauthorized transactions immediately to your bank.

Educate Yourself and Others: Attend cybersecurity awareness sessions and educate family members, especially elderly individuals.

Install Security Software: Keep antivirus and anti-malware software updated to prevent cyber threats.

Whom to Inform in India

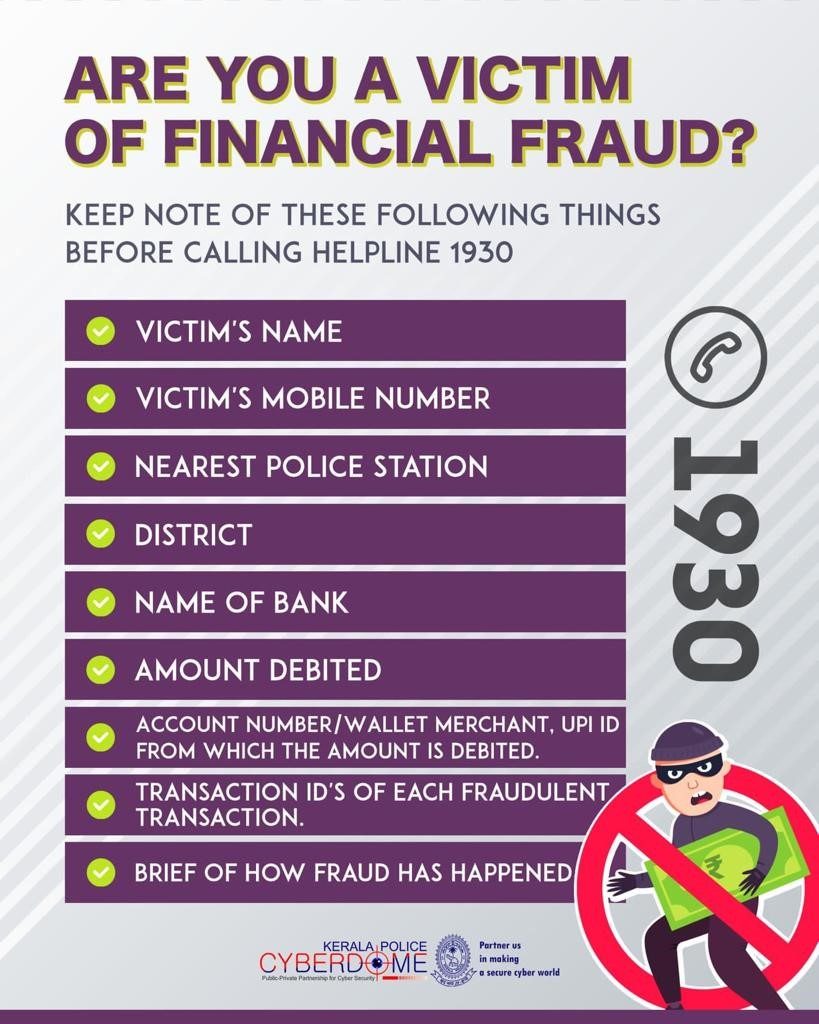

IF you or someone you know falls victim to cyber fraud, report it immediately to:

National Cyber Crime Reporting Portal: www.cybercrime.gov.in

Cyber Crime Helpline: 1930

Local Police Station: Lodge an FIR at the nearest police station.

Reserve Bank of India (RBI) Ombudsman: For banking frauds, contact the RBI’s ombudsman services.

Your Bank: Report fraudulent transactions to your bank’s fraud department immediately.

Cyber frauds are a growing menace, and the elderly are particularly vulnerable. Awareness and vigilance are the keys to avoiding financial and emotional distress. By staying informed, adopting preventive measures, and promptly reporting frauds, we can safeguard ourselves and our loved ones from digital threats. Let’s spread awareness and help our senior citizens navigate the digital world safely!

(Dr Amit Dias is a epidemiologist and geriatrician and has been working with the elderly. He was the nodal officer for IT at the Goa Medical College & Hospital and is keen on technology and health.)